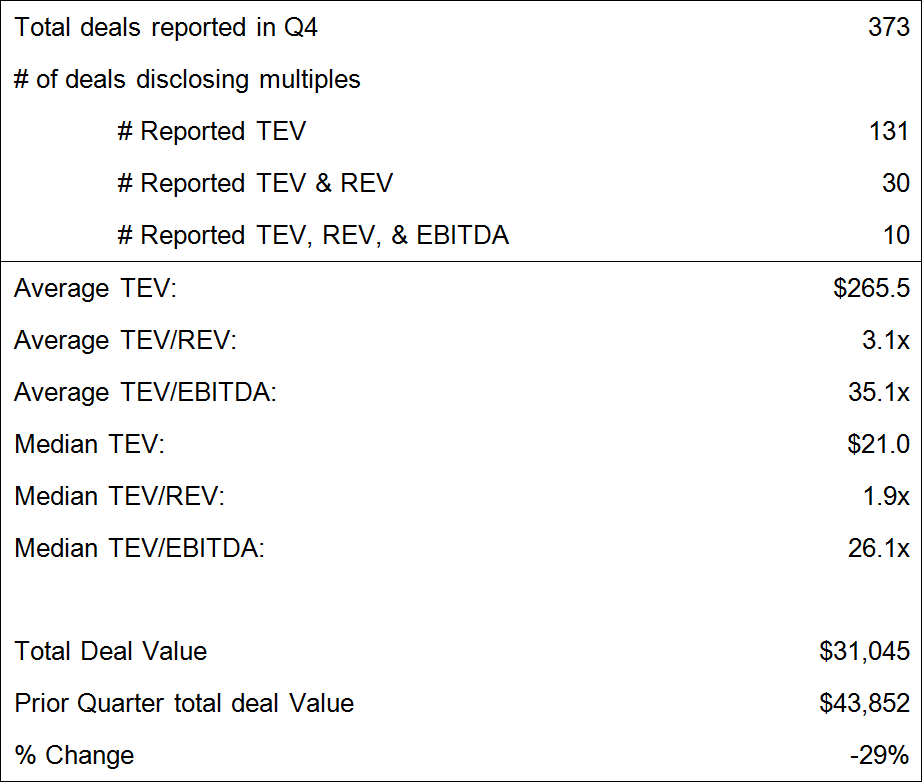

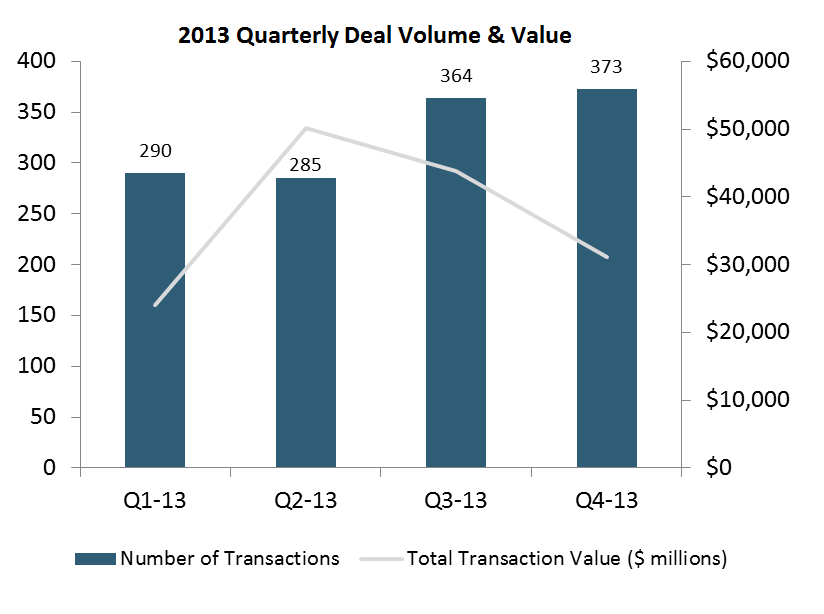

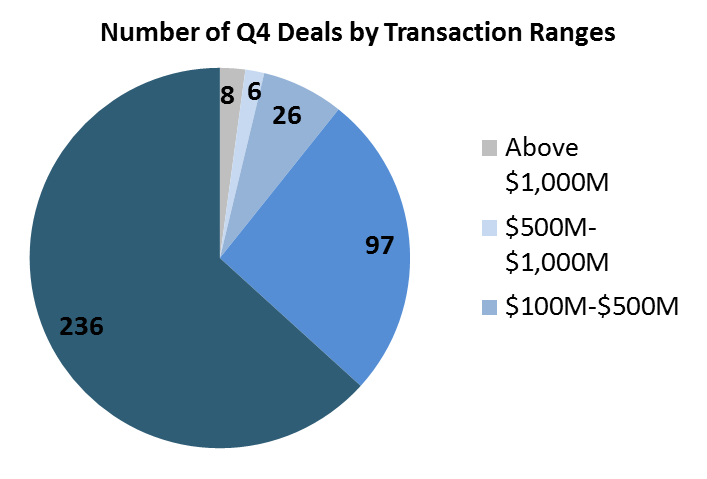

For Q4’13, TripleTree tracked 373 healthcare mergers and acquisitions with a total and median enterprise value of $31.0 billion and $21.0 million, respectively. Healthcare M&A deal volume increased 2% Q/Q. However, with the average enterprise value decreasing from nearly $300 million in Q3 to $265.5 million in Q4, total deal value fell 29% Q/Q.

Deal volume was distributed across the following sectors:

- Healthcare Technology: 45 transactions

- Managed Healthcare: 9 transactions

- Healthcare Facilities: 89 transactions

- Healthcare Services: 87 transactions

- Pharmaceuticals: 40 transactions

- Biotechnology: 22 transactions

- Life Sciences Tools & Services: 13 transactions

- Healthcare Supplies: 10 transactions

- Healthcare Distributors: 16 transactions

- Healthcare Equipment: 42 transactions

We have previously discussed the surge in the volume of deals in the healthcare facilities subsector, a trend that has held since 2012. While healthcare facilities still saw the most number of deals (89), healthcare services (87 deals) was not far behind. This does, however, continue to point to the trend of consolidation in both the services and facilities market, as providers attempt to gain market share and power while navigating the turbulent waters of the impending post-reform environment. Healthcare technology showed a meaningful uptick in deal volume, as healthcare companies build out technology to support health insurance exchanges and other market changes.

There were three noteworthy transactions in the healthcare technology subsector for Q4:

- Towers Watson (NYSE:TW) acquired Liazon Corporation, an operator private benefits exchanges for employees,for $215 million. Towers Watson has stated that they are extremely bullish about the private exchange market, and that adoption is proceeded even more quickly than they projected, and the Company believes that there could be somewhere between 35 and 70 million covered lives served by private benefits exchanges within five years. Towers is positioning themselves to be a leading player in the space, and where looking to expand their market share, capability set, and growth potential. The acquisition allows Towers Watson to expand their existing OneExchange capabilities, which currently serve the large employer and retiree markets. But most importantly, their acquisition of Liazon expands their customer reach past large employees and into the middle market while greatly expanding the number of employee lives they’re currently serving. So far, the public markets have reacted favorably to the acquisition, with Towers Watson’s stock hitting an all-time high near the end of the fourth quarter.

- Experian (LSE:EXPN) acquired Passport Health Communications for $850 million. More information can be found here.

- Hearst Corporation acquired an 85% position in Homecare Homebase, a Dallas-based provider of comprehensive software-as-a-service solutions to the homecare and hospice market for an undisclosed price. The acquisition highlights a number of trends in the market right now – the need for technology-enabled care coordination and the growth in the home care and hospice markets. Homecare Homebase’s technology effectively enables real-time sharing of data and information between providers and the home health and hospice agencies, allowing for the effective management of their patient population and a streamlined workflow. Secondly, the market for hospice and home health continues to be an area of very strong growth. As the population of patients who opt for the more cost-effective care provided through hospice and home health over than costly hospital stays grows, as does the market for software and services that enable the most effective care. Hearst has been unafraid to make big bets in the healthcare market, and the Company has done just that with their acquisition of Homecare Homebase – but they have acquired a best-in-class asset in the process. For the market as a whole, it sends a signal that premium assets are subject to as much competition as ever, with both traditional and non-traditional buyers alike willing to pursue large acquisition opportunities, even at premium prices.

Despite major U.S. market indices continuing to rise, healthcare IPO activity in Q4 was relatively weak – only 6 healthcare companies had successful IPOs totaling ~$450 million of transaction value, while a number of announced IPOs were delayed or postponed. However, 21 additional IPOs were announced during Q4 that have not yet closed, representing a potential ~$1.8 billion of transaction value.

As in the broader healthcare market, IPO activity in TripleTree’s traditional focus sectors was tepid, with the exception of the announced IPO for Medical Transcription Billing Corp (NASDAQ:MTBC):

- On December 23, 2013, Medical Transcription Billing Corporation (MTBC) announced that the Company had filed registration statements with the SEC for its initial public offering on The NASDAQ Global Market [press release]. MTBC provides practice and revenue cycle management services and proprietary software solutions to private physician offices and hospital-employed provider groups throughout the United States.

Look for a more comprehensive view of capital markets activity in our Quarterly ValueTracker which will be published in the coming days.

Until then, let us know if you have any questions.