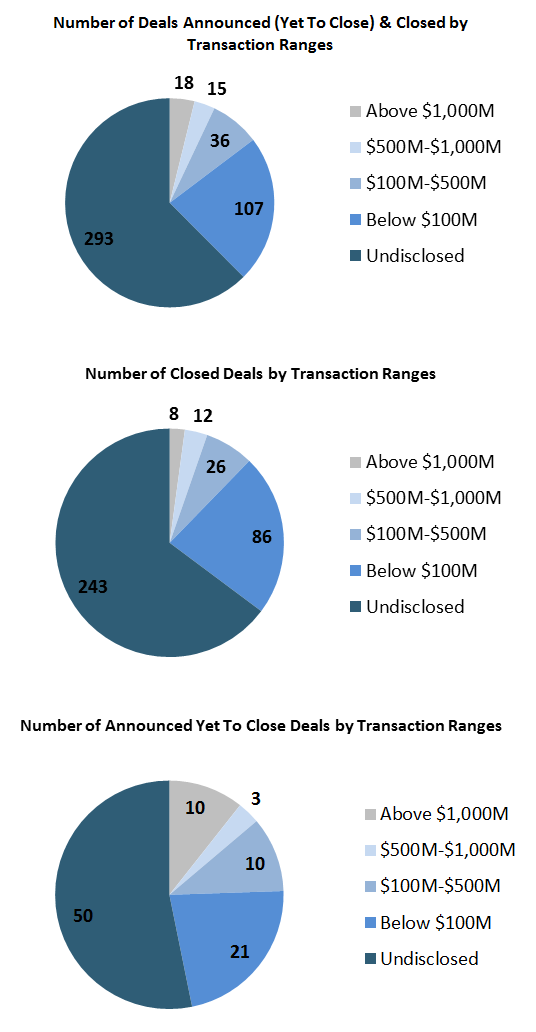

For Q3 ‘14, TripleTree tracked 469 healthcare mergers and acquisitions that closed or were announced but have yet to close.

The 469 deals had a total and median enterprise value of $11.9 billion and $46.8 million, respectively. In the following charts we have broken out detail on closed deal volume across the healthcare services, facilities and technology (243 transactions); life sciences technology and services (84 transactions); and healthcare equipment and distribution (48 transactions) sectors.

Q3 experienced a decrease in aggregate announced and closed transaction value, due mainly to the large, high-profile trades that were announced in Q2, including Valeant Pharmaceuticals’ $60 billion buyout of public pharmaceutical company Allergan, Medtronic’s acquisition of Covidien (valued at over $46.9 billion), and the $54.6 billion announced acquisition of Shire by AbbVie (and as of early Q4, AbbVie has backed out of this announced deal). While these deals were all announced in Q2, none were consummated during the second or third quarter causing a significant decrease in overall M&A activity. However, Q2 saw a 295% increase in closed deal value in Q3 as compared to the prior quarter.

The closed deal transaction value was led by Actavis plc’s $25.5 billion acquisition of Forest Laboratories, Brookdale Senior Living’s acquisition of Emeritus Corp., as well as other large, mainly pharmaceutical trades.

It is likely that the strong growth in M&A closing activity should continue to rise into Q4, as remaining high-profile deals announced throughout the year, including the $2.7 billion acquisition of TriZetto Corp. by Cognizant in the latter half of Q3, continue to close.

Deal Stratification

By our count, deal volume was distributed across the following sectors:

- Healthcare Services: 103 transactions

- Healthcare Facilities: 99 transactions

- Pharmaceuticals: 44 transactions

- Healthcare Equipment: 34 transactions

- Healthcare Technology: 33 transactions

- Life Sciences Tools and Services: 23 transactions

- Biotechnology: 17 transactions

- Managed Care: Eight transactions

- Healthcare Supplies: Seven transactions

- Healthcare Distributors: Seven transactions

Two Noteworthy M&A Transactions from the Quarter:

- Cerner Corporation (Nasdaq: CERN) Acquires Siemens Health Services. On August 5th, Cerner Corporation (Nasdaq: CERN), a healthcare information technology giant specializing in electronic health record (EHR) systems that combine clinical, financial and management information systems into one platform, announced an agreement to acquire substantially all the assets of Siemens Health Services from Siemens Healthcare for $1.3 billion. Siemens AG, the selling parent organization, is a German electronics and electrical engineering industrial conglomerate, whose healthcare business specializes in developing and manufacturing diagnostic, therapeutic and imaging devices, in addition to the healthcare IT service portion which Cerner is purchasing.

The transaction is indicative of Cerner’s strategic desire to add scale in order to compete in the healthcare provider IT marketplace with current competitors such as Epic, who has had a stranglehold on what is considered a relatively saturated market in larger-scale hospitals and health systems, and athenahealth, whose innovative product has been claiming a growing share of the market. Together, the combined Cerner/Siemens entity will have a $650 million research and development budget to drive innovation as market demands continue to evolve.

- Cognizant Technology Solutions (Nasdaq: CTSH) Acquires TriZetto. Cognizant Technology Solutions (Nasdaq: CTSH), a provider of Information Technology (IT), Consulting and Business Process Outsourcing (BPO) solutions worldwide, announced the acquisition of TriZetto Corporation for $2.7 billion in cash. TriZetto provides IT and other service solutions focused on administrative and quality of care efficiencies to health plans, benefit administrators, providers, hospitals and health systems. The addition of TriZetto will strengthen Cognizant’s already strong Healthcare footprint and will provide an opportunity to cross-sell current IT and BPO services into TriZetto’s client base.

Cognizant credited their knowledge and experience working with TriZetto as an important factor in the transaction, as their multitude of mutual clients have shown first-hand the quality and service that the TriZetto platform offers. As a leading provider of technology-based solutions that address needs of customers on both the payer and provider side of the healthcare market, TriZetto enables Cognizant to realize substantial revenue synergies upwards of $1.5 billion over the next five years by expanding their addressable market. TriZetto currently provides administrative solutions to roughly 350 payer organizations that cover upwards of 180 million livesin addition to providing SaaS based Revenue Cycle Management (RCM) services to over 245,000 providers. TriZetto will bring over 3,500 employees to Cognizant’s healthcare business.

Public Markets

The relatively strong year of IPO activity continued in Q3, as 22 healthcare companies had successful IPOs totaling $2.3 billion of transaction value, and an additional 22 companies announced initial filing for IPOs during Q3 that had not closed as of quarter end. These announced deals represent an incremental ~$1.8 billion of enterprise value.

This Q3 Roundup was pulled from our Quarterly ValueTracker, which includes additional insights about related healthcare news and activity during the quarter – it can be downloaded here.