Our 2025 TrendWatch blog outlined several key sectors where we expected to see outsized attention, investment, and potential further industry consolidation. Now TripleTree is reflecting on the year-to-date market trends that have framed 2025 deal activity and looking ahead to the final months of the year.

We invite you to dive deeper into how our early-year trend insights are playing out well into 2025.

Exceptional Results at Scale

The Healthcare Technology and Services sector has remained relatively quiet in 2025, supporting a theme that has been omnipresent for the past few years. While this sobering market hasn’t exactly been user-friendly for many in the M&A business, TripleTree has consistently delivered exceptional results for its clients - at scale.

"We are proud, grateful, and humbled by the opportunity to secure outstanding outcomes for our clients at such a turbulent time. Earning the partnership of extraordinary companies, exceptionally detailed up-front planning and diligence, the undivided attention of deal teams at every level, and the execution of highly tailored and accurate processes leads to investors and buyers genuinely leaning into TripleTree's clients," said Justin Roth, Head of Investment Banking, TripleTree.

Here’s a snapshot of some of TripleTree’s notable recent milestones:

- 2024 marked the best year in TripleTree’s history, closing 25 transactions with an average Enterprise Value of $1.2B

- TripleTree’s transaction trajectory has remained strong in 2025 with 30 transactions signed and/or closed as of October 2025

Investments Across AI & Tech Are Driving Disruption & Deals

Throughout this year, we have seen organizations increasingly turning to technology investments and/or support from scaled, technology-enabled partners. This trend, particularly in the provider space, will continue to gain momentum and investment interest.

For Revenue Cycle Management (RCM) businesses, both incumbent and newly launched, investments in artificial intelligence (AI), large language model (LLM), and automation technology will remain a focus leading into 2026. These investments are critical to remain out front of an increasingly competitive ~$100B market. As the entire industry seeks to win and better support healthcare providers amdist mounting financial pressures, this technology will continue to be a vital lever in managing costs and achieving operational efficiencies.

Notably, investors and buyers are increasingly scrutinizing AI risk and opportunity with respect to the RCM companies they are evaluating. Stakeholders know that AI will undoubtedly have an impact, but the extent to which AI transforms specific areas of RCM is still relatively uncertain - and as a result, the bar for risk appetite and deal making is increasingly high. The most near-term and actionable areas where AI is being applied in RCM and having a disruptive impact include Denials Management (DM), Coding, and Clinical Documentation Improvement (CDI).

We are tracking a multitude of use cases for AI in DM, particularly around the appeals workflow. Within Coding and CDI, AI can be a powerful force for creating compliant documentation in a more prospective (versus retrospective) fashion. These examples, among others, are driving efficiency and improved accuracy in the sector.

Companies like CorroHealth, RevSpring, and Omega are actively deploying AI and automation technology to drive efficiencies and improved accuracy into their organizations. MDAudit is leveraging their inventive software platform to process expansive data sets and deliver data-driven solutions, while also investing in innovative ways to leverage AI and other technologies that drive measurable benefit and ROI for their hospital customers.

We expect the pace of transformation to accelerate in RCM as more capital pours into these businesses and the incumbents accelerate their investments in technology, new products, offshore infrastructure, and M&A. End-to-end and broader, modular-focused vendors with scale and reputable customer bases will be the best positioned to expand and further consolidate the market. The adoption curve for AI, in particular, is exponential, not linear. As these models gain more traction and incorporate the large data sets of healthcare organizations and RCM providers, AI will become a critical enabler to improve operational efficiency and accuracy.

We also expect to see a number of businesses across RCM in the core to upper-middle market (e.g., EBITDA $20 - $100M+) explore the market, including businesses that are:

- focused on specialty areas within the physician and ambulatory RCM segment, such as anesthesiology, radiology, or behavioral health

- addressing a broad capability set across the health system end-market

- designed with more specialized, tech-enabled RCM capabilities, focused on a particular point solution

An Optimistic Tone for Multi-Site Healthcare Opportunities

The multi-site healthcare sector is seeing several "green shoots" that are encouraging for deal activity in the back half of this year and into early 2026.

With the final round of sequestration-relationed government reimbursement cuts landing earlier in 2025, there is significant political pressure on Congress to improve reimbursement for physicians. This will likely create some upside on rates, which has long been a challenge for providers. However, the recent physician pay increase proposal from the Centers for Medicare & Medicaid Services (CMS) is giving hope to providers that their reimbursement rates may start to make up ground against fast-increasing labor rates.

Additionally, we are noting some trends that will positively affect investment activity in both the short and long-term:

- Commercial reimbursement rates are improving in select specialties

- Wage inflation seems to have moderated

- Clarity in Federal Trade Commission (FTC) priorities continues to improve and increase

- Patient demand for healthcare services is becoming more consistent and predictable

- Strategic buyers are increasingly active in sell-side processes for scaled Physician Practice Management (PPM) assets

The fundamental rationale for building PPM platforms remains as relevant as ever:

- Delivering care to patients is getting more complex, not less

- Small physician groups are less equipped to deal with the various headwinds and complexities of our healthcare system

- Changing physician preference means earlier-career physicians are less interested, and less financially capable given their med school debt load, of "being their own boss" and starting their own practices

- In a world where there is not enough clinical supply (physicians) to meet clinical demand (patients), having a business with scale is one of the few ways providers can drive efficiency, even if modest, to see more patients and close that clinical gap

The challenges of the past several years have acutely highlighted the benefits to physicians that come with scale and investment, and things are not slowing down. With more clarity and demonstrated impact across many dimensions of the healthcare ecosystem, we are optimistic about the upward market momentum.

TripleTree's recent work across the PPM spectrum - dental, cardiovascular, musculoskeletal (MSK), dermatology, surgicalist - gives us a unique level of insight into how investors and acquirers are thinking about PPM and multi-site healthcare.

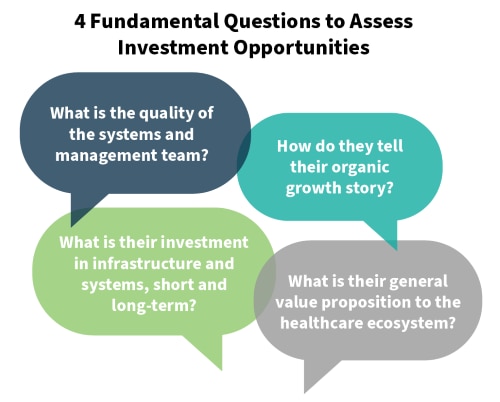

At its foundation, buyers need to focus on four fundamental questions as they assess opportunities:

Selective deal activity in these sectors will increase in the remainder of this year. Consequently, quality assets that need fresh capital and investors who see a buying opportunity will be looking for partners. With an unwavering focus on quality and organic growth, platforms will be leaning into comprehensive value creation playbooks that outline how these platforms make the lives of physicians and patients better.

Sound Solutions Underpin Stability in the Managed Care Sector

It has been a bumpy year for the managed care sector, with multiple health plans reducing or withdrawing guidance as they work through regulatory changes, increasing Medical Loss Ratios (MLRs), tighter margins, and reduced federal support for Medicaid and Affordable Care Act (ACA) programs.

That said, the sector is expected to remain stable with continued investments in infrastructure and solutions that are helping to drive value-based care delivery and manage margins in critical ways:

|

TripleTree’s success in 2025 highlights a resilient market for top performing platforms despite uncertainty, and we have seen significant M&A across many of the areas we highlighted in our 2025 Trendwatch blog, including healthcare technology and specialized healthcare services. Inorganic growth conversations with strategic acquirers have accelerated in the last several months, and this foretells an uptick in transaction volume as we close out 2025 and turn our attention to 2026. Our focus remains on the technology and services areas, where we will be paying particular attention to more budget clarity in government funded programs around Medicare and Medicaid. This greater insight will allow strategics with large exposure to those programs to execute on growth plans with new economic clarity. While stabilization in government-funded programs is certainly a significant factor that will draw attention, it won't be the sole catalyst influencing M&A activity moving forward. We anticipate that internal alignment and resource commitment within private sector entities will play an equally vital role. As organizations finalize their comprehensive strategic blueprints, identifying both core competencies to nurture and areas requiring external augmentation through acquisition becomes much clearer. This clarity, driven by internal decision-making regarding capital deployment towards specific high-growth vectors—especially those leveraging advanced data analytics to unlock clinical and administrative data for improved patient outcomes and cost management—suggests a sustained, self-driven momentum in deal flow. |

|

We look forward to continuing to engage with strategic acquirers as we move into the next phase. We are eager to share our perspectives gained from our transaction activity throughout 2025 and to highlight the specific companies and sectors we anticipate will be actively coming to market over the next few quarters as strategic planning translates into execution.

At TripleTree, we’ll continue to provide insights on market-leading trends and conversations that are shaping healthcare. Read more about what's transforming the healthcare landscape in previous TripleTree publications or reach out for more information.