The pharma supply chain is undergoing a fundamental transformation, driven by complex new therapies, increasing regulatory scrutiny, and a push for greater transparency, efficiency and resiliency through digital innovation. Today, the pharma supply chain is a strategic, high-stakes, and tech-enabled frontier with key stakeholders and investors alike coming to appreciate the supply chain no longer as simply a cost center but a critical asset that can create, or destroy, the value of therapy.

Pharma Supply Chain Market At-a-Glance

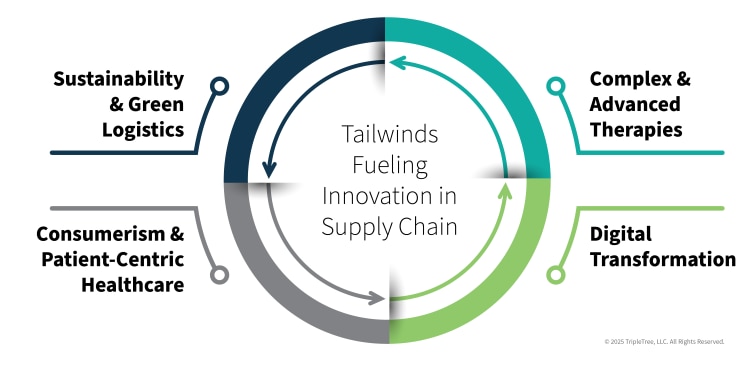

A strong, durable, and evolving supply chain is vital for continued drug innovation and improving patient outcomes. The pharma supply chain is facing several unique challenges while simultaneously fueled by broad macro tailwinds that are driving continued innovation. Some of the most pressing challenges in the market include:

Drug Shortages & Disruptions: Drug shortages present a significant and growing issue for the healthcare ecosystem as a whole. In early 2024, the American Society of Health-System Pharmacists (ASHP) reported the highest all-time number of active drug shortages at 323 which has marginally declined, but remains historically elevated, through 2025. The cause of drug shortages can be wide-ranging, including raw material shortages, manufacturing quality issues, regulatory changes, extreme weather, or supply chain disruptions, to name a few. As a result, drug shortages or supply disruptions can be complex and time-consuming to resolve, with over 40% of active drug shortages starting in 2022 or earlier.

This trend signals a clear investor takeaway: the market is fundamentally shifting from prioritizing lowest cost and ‘just-in-time’ efficiency to demanding ‘just-in-case’ strategies for supply chain resilience. This disruption is driving growth for companies with two complementary, ‘must-have’ capabilities: physical preparedness and digital foresight. LGM Pharma, backed by New Harbor Capital, delivers this critical physical preparedness, offering services such as strategic inventory management, securing dual sourcing for active pharmaceutical ingredients and raw materials, and providing contingency manufacturing solutions that address the root cause of supply disruption. Resilinc, a Vista-Equity Partners-backed platform, provides the digital foresight, using predictive analytics to monitor global suppliers for events like raw materials issues, regulatory halts, or natural disasters that could trigger shortages.

Fraud, Waste & Abuse: The broader healthcare ecosystem is losing billions of dollars a year due to drug-related fraud, waste and abuse (‘FWA’); and the pharma supply chain’s complex, multi-constituent nature provides multiple points of vulnerability to enable such losses. Pharma and biotech lose ~$35B per annum due to failures in temperature-controlled logistics (e.g. cold-chain). alone, before considering the downstream impact on providers, health systems, and patients. Notably, a majority of losses from FWA are preventable, providing a clear incentive for both drug manufacturers and global supply chain platforms to continue adopting new, innovative solutions to enhance the supply chain and reduce leakage.

This ~$35B leakage represents a massive opportunity for ‘active prevention’ technologies that can demonstrate a clear ROI. This is driving growth for companies that combine smart cold chain infrastructure (like advanced thermal containers) with data and analytics (leveraging IoT and serialization data) to actively prevent product loss and diversion. AeroSafe Global and CSafe are at the forefront, providing the mission-critical, tech-enabled platforms to manage the entire high-stakes logistics process from end-to-end.

Regulatory and Compliance Complexities: Global supply chains are being re-evaluated for safety, resilience and diversification, with a heightened focus on improving visibility and reducing single sourcing. The most recent examples include the sweeping ‘track-and-trace’ regulatory changes enacted by the Drug Supply Chain Security Act (DSCSA), and the Trump administration’s focus to reshore Active Pharmaceutical Ingredient (API) production and diversify sourcing. Such initiatives are intended to provide a pathway to resolve critical drug development and supply-chain issues, but present unique near-term challenges around new technology implementation, large-scale operational and infrastructure overhauls, and forecast / demand planning.

Legacy Infrastructure: Legacy infrastructure in the pharma supply chain was built for economies of scale, primarily to commercialize small molecules to large, global addressable populations. In seeking to manage the increasing volume of specialty drugs for narrower populations, often with unique handling requirements, pharma manufacturers are increasingly adopting multi-vendor strategies to ensure all drug-types are safely and compliantly tracked and distributed across the supply chain.

Based on this trend, investors must recognize the fragmenting “one-size-fits all” model creates a significant opportunity for platforms that can manage this complex, multi-vendor ecosystem by providing predictive analytics, data-driven visibility, and active monitoring for high-cost specialty drugs with unique handling. VPL (Vantage Point Logistics), backed by LLR Partners, delivers this visibility, offering a software solution that gives supply chain leaders detailed shipping analytics and patient-level tracking. ParcelShield, an Excellere Partners-backed platform, provides the active monitoring using predictive analytics and intervention services to ‘rescue’ critical, time-sensitive drug packages at risk of delivery failure – a must-have capability in a specialty-driven market.

Global, Multi-Constituency Market: The pharma supply chain is comprised of a network of fragmented constituents that can make it difficult to not only deliver consistent services, but also introduce various hurdles to adopt, implement and scale new solutions across the value chain. Examples include maintaining consistent product integrity from development to delivery, conflicting priorities or incentives in product handling leading to “not my problem” mentalities, or lack of data interoperability across information siloes.

This fragmentation and its resulting data silos create a need for a central, interoperable platform that can act as the ’connective tissue’ or ‘control tower’ for the ecosystem. IntegriChain, backed by Nordic Capital, serves this role by integrating channel, patient, and payer data to help manufacturers manage contracting, pricing, and gross-to-net. Similarly, TraceLink, provides the network infrastructure to manage the flow of serialization data between manufacturers, third-party logistics, distributors, and pharmacies, connecting the entire supply chain.

Focus on Innovation & Technological Adoption

The rise of complex and advanced therapies is changing the pharma landscape across multiple dimensions. The pipeline of new drugs is increasingly dominated by biologics, cell and gene therapies, and personalized medicines, with specialty drugs now representing ~75% of the 7,000 new drugs under development. These therapies require highly-specialized handling, storage, and transportation, driving demand for advanced logistics and cold chain services.

Concurrently, the pharma supply chain continues to experience significant digital transformation. With an industry that is moving away from manual, paper-based systems toward digital supply networks, investments in AI, machine learning, and the Internet of Things (IoT) are enabling real-time tracking, predictive analytics, and enhanced visibility, which are critical for both operational efficiency and regulatory compliance. Such technologies will also seek to unlock more transparency and traceability across the product journey to root out the meaningful fraud, waste and abuse while also improving the patient experience and clinical outcomes. While still in the early stages of global adoption and deployment, this transition presents a massive opportunity for new market entrants and investors.

As consumerism and more patient-centric healthcare permeates the broader healthcare landscape, pharma and biotech are following suit through the adoption of patient-centric supply chain strategies. In mature markets such as specialty pharmacies and hub services, to emerging markets like ‘last mile’ logistics, smart packaging and DTP engagement technologies, meaningful room for innovation, integration and digitization exists today. Providers, healthcare providers (HCPs), and pharmacies, in particular, will all play a role in enacting disruptive DTC/DTP initiatives, opening a role for platforms with broad ecosystem integrations and value-enhancing network effects.

The overarching themes of sustainability and green logistics have garnered notable attention in recent years. Environmental, Social, and Governance (ESG) concerns are becoming a major consideration for investors and regulators. This is pushing companies to adopt more sustainable practices, from optimizing transportation routes to using eco-friendly packaging and reducing energy consumption in their facilities.

Finally, while this blog is largely focused on the supply chain for approved therapies and their respective ingredients, the global clinical trials market continues to evolve and equally presents unique opportunities for investors. Beyond the last-mile requirements and complex handling required for specialty investigative compounds, as mentioned above, clinical trial operators are also seeking tailored solutions or technologies to manage procurement of conventional treatments, demand forecasting, and inventory management, among other complex challenges. We are also seeing an ongoing shift in the clinical trial site market, with community-based, embedded (or integrated), and decentralized / hybrid models aiming to take share of patient enrollments. As these models continue to take shape, clinical trial supply chain platforms will need to equally transform to meet any unique needs these models present.

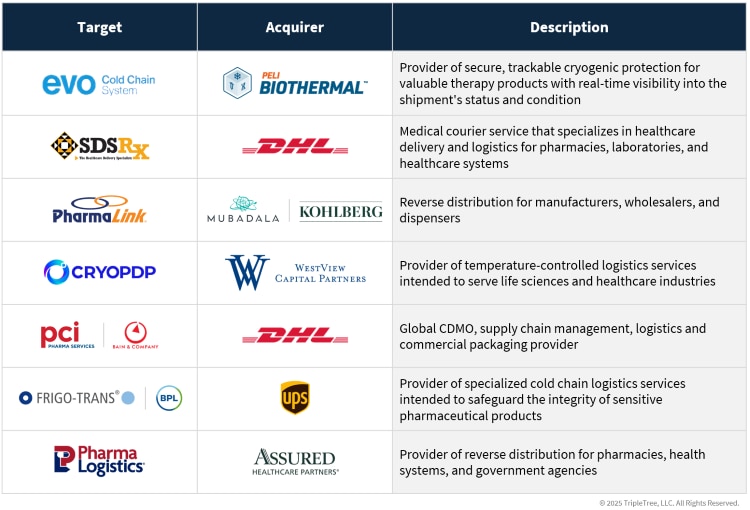

Notable M&A Activity in the Pharma Supply Chain

The M&A market for pharma supply chain solutions remains active and a thematic focal point for investors, but we believe it’s still in the early innings of maturity and consolidation. The landscape is flush with new market entrants with value propositions spanning every level of the supply chain; combined with the long-term tailwinds highlighted above and market demand for innovation, we expect the category to be a driver of M&A activity in the coming years. Beyond the platforms currently in market across procurement, cold-chain, and last-mile delivery, below are examples of some recent trades in the space.

A Strategic Blueprint for the Future

The pharma supply chain is no longer a static, backend operation; it is a dynamic, critical component of drug development and patient care. The confluence of advanced therapies, technological innovation, and stringent regulatory mandates like the DSCSA has created both challenges and opportunities. For investors, success lies in identifying the companies that are not just adapting to these changes but are driving them. The future of the pharma supply chain belongs to those who can master more complex logistics strategies, harness digital technology for end-to-end visibility and broad network connectivity and navigate the evolving regulatory landscape. By focusing on these key areas, investors can position themselves to capitalize on the next wave of growth in the pharma and biotech services sector.

At TripleTree, we’ll continue to provide insights about how the pharmaceutical industry is driving technology changes across healthcare - resulting in meaningful solutions that are addressing the industry’s rapidly evolving challenges. Read more about how technology is transforming the healthcare landscape in previous TripleTree publications or reach out for more information.