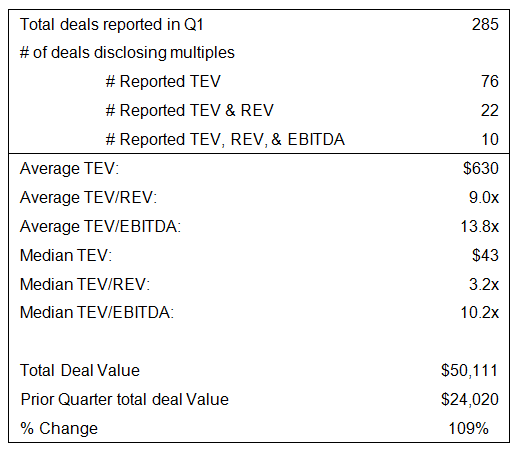

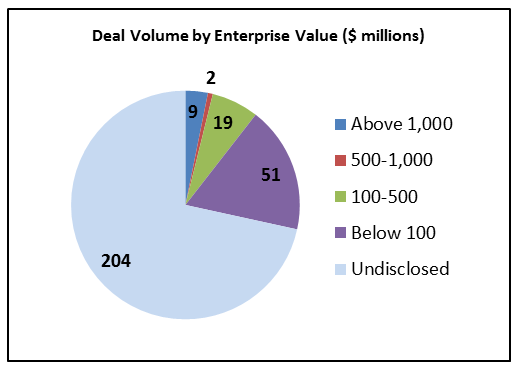

For Q2’13, TripleTree tracked 285 healthcare mergers and acquisitions with a total and median enterprise value of $50.1 billion and $43 million, respectively. Healthcare M&A deal volume remained relatively flat Q/Q. However, with nine healthcare deals topping the billion dollar mark in Q2, total healthcare M&A value increased 109% Q/Q. The deal volume is distributed across the following healthcare sectors:

- Healthcare Technology: 30 transactions

- Managed Healthcare: 4 transactions

- Healthcare Facilities: 88 transactions

- Healthcare Services: 55 transactions

- Pharmaceuticals: 33 transactions

- Biotechnology: 19 transactions

- Life Sciences Tools & Services: 11 transactions

- Healthcare Supplies: 6 transactions

- Healthcare Distributors: 8 transactions

- Healthcare Equipment: 31 transactions

Continuing the trend from 2012 and Q1’13, the healthcare facilities subsector had the most transactions (88) for the quarter, with many of the transactions being small, strategic deals. Healthcare providers are beginning to take on more risk through value-based care initiatives and the creation of ACOs. In order for providers to thrive in a risk-bearing environment, they need to gain scale by acquiring smaller hospitals, physician practices, and ancillary healthcare service providers. In addition, providers that rely on state Medicaid reimbursement are under pressure to gain efficiencies as state budgets reduce expenditures. These factors continue to drive consolidation among healthcare providers.

The biggest transaction in the healthcare facilities subsector during the quarter was Tenet Healthcare’s (NYSE:THC) acquisition of Vanguard Health Systems (NYSE:VHS) for approximately $1.8 billion (press release). Tenet’s offer of $21 in cash for every Vanguard share represents a 70% premium over Vanguard’s closing stock price on the day before the transaction. Tenet will also assume $2.5 billion in Vanguard debt.

Q2 deal activity also demonstrated a growing market demand for Clinical Research Organization (CRO) services. This growth is primarily driven by increased R&D spending by biopharma organizations and the trend toward outsourcing biopharma R&D. Two major transactions that together resulted in over $6 billion in value illustrate this market shift:

- Quintiles Transnational Holdings (NYSE:Q), backed by Bain Capital and TPG Capital, completed its IPO, selling 23.7 million shares with gross proceeds of $947 million (press release)

- Kohlberg Kravis Roberts & Co. (NYSE:KKR) acquired PRA International for approximately $1.3 billion from Genstar Capital (press release)

Look for a more comprehensive view of capital markets activity in our upcoming ValueTracker, due out later this month.

Until then, let us know if you have any questions.