Healthcare deal activity quickly recovered in the late spring of 2020 and has remained strong during the pandemic, accelerating considerably in the second half of the year. The U.S. diagnostic imaging sector, ranging from freestanding outpatient centers to specialized radiology practices and serving providers across the country, has been no different and is currently in the midst of a strong revival of investor interest. In this blog we explore imaging in greater detail, including an examination of the different sub-sectors, a review of important trends fueling industry tailwinds and a recap of key transactions and industry players to watch.

Understanding the Sector Landscape

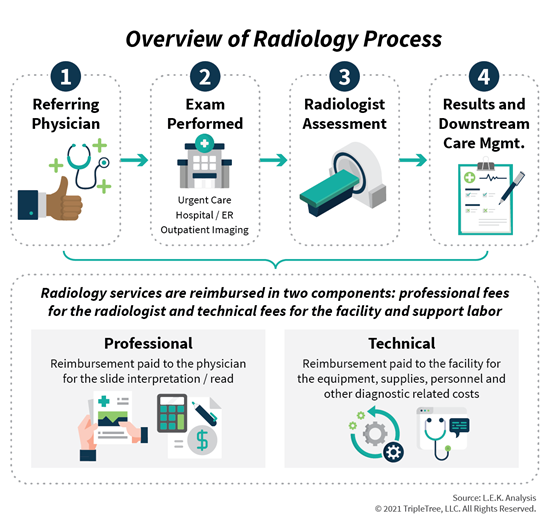

The two key sub-sectors in the industry are freestanding outpatient imaging centers and radiology physician practice groups. The more than 6,000 non-hospital diagnostic imaging centers and physician offices account for roughly 40% of procedure volume in the estimated $100 billion U.S. imaging market. Their fees are based on the type of modality used for a scan, ranging from routine to advanced.

1 Radiologists review and interpret the images, diagnose a patient’s condition and make recommendations for treatment, collecting a professional fee. There are more than 30,000 radiologists in the U.S. today, performing reads either on-site at hospitals, centers or physician offices, or remotely through teleradiology.

Diagnostic imaging has been through many ups and downs over the last 20 years, generally proving to be a contrarian play for investors. Plagued with persistent reimbursement pressure and meaningful capex requirements, interest in imaging has remained muted, and multi-site deal activity has been dominated by more asset-light, higher growth provider and services segments. An aging U.S. population and technological advances have helped fuel scan growth and boosted the entire imaging sector, but several key trends have altered the dynamics in the diagnostic imaging center space specifically, and are driving today’s heightened deal activity:

- Payers are increasingly pushing procedure volume out of hospitals to lower-cost outpatient settings. For example, on August 1, 2020, Cigna implemented a new policy restricting outpatient advanced radiologic imaging procedures in the hospital setting, a similar policy move to those implemented by Anthem in 2017 and UnitedHealthcare in 2019

- Patient experience is also a factor in a shift to outpatient, as patients tend to see better service and shorter wait times in an outpatient setting - a preference accelerated by Covid-19, where speed, lighter crowds and hospital avoidance are at a premium

- The segment remains meaningfully fragmented, with the top 10 outpatient center operators accounting for less than 20% of the total market of more than 6,000 centers. Smaller operators tend to be more single-modality focused (and therefore more exposed to potential reimbursement changes), poorly capitalized, and less likely to be in-network with local payers

- Finally, after years of steady decline (2007-2014), reimbursement has remained relatively stable over the last several years. Recent reimbursement changes have targeted outdated technology, reducing reimbursement for film-based X-rays and computed radiography (CR), encouraging the move to more digitized imaging solutions and modalities

The Consolidation Advantage

These trends are some of the key factors behind both an accelerating consolidation trend, as well as for platform investments by financial investors. Some recent notable deals include the following:

- Comprised of 334 centers, RadNet (NASDAQ: RDNT) is the largest owner-operator of fixed site imaging centers in the U.S. In October, they announced joint venture (JV) partnerships with two prominent health systems - Adventist Health in California and CommonSpirit Health in Arizona. The latter move also included the acquisition of eight locations in Phoenix

- Wellspring Capital-backed Centers for Diagnostic Imaging (CDI) entered the Utah market in November 2020 with two acquisitions, adding eight centers. Most recently, they opened their 15th location in their home market of Minneapolis, expanding their total center count to more than 130 centers across 22 states

- Perhaps the most active imaging center consolidator recently has been Akumin (NASDAQ/TSE: AKU), adding ~40 centers in seven deals throughout 2019 and 2020, including a signature transaction acquiring Advanced Diagnostic Group, a 27-center personal injury-focused business in Florida and Georgia in May 20192

Radiology services are critical to diagnosing and directing treatment to the most appropriate clinical pathway and can influence many downstream care processes. Effective deployment of high-quality reads can help reduce inappropriate medical spend and enhance clinical outcomes, both core tenets of any value-based care strategy. Given most hospitals do not have the scale required for a fully staffed radiology team with sub-specialty expertise, combined with the fact that radiologists do not direct referrals, 85-90% of hospitals outsource radiology to specialized radiology practices. The aging of America is helping drive scan volume, as noted above, and several additional factors are further fueling the current wave of deals in the space:

- The competitive landscape for outsourced radiology services is highly fragmented. The top 100 practices represent less than 20% of the total market and Radiology Partners, by a wide margin the leading radiology business in the U.S., has less than 5% market share

- Financial stress on smaller practices has accelerated the pace of consolidation. 50% of practices have less than 10 radiologists, and struggle to keep up with the costs of IT investment and increasing hospital expectations

- The advantages of scale are undeniable. Better economies of scale create meaningful operating leverage with IT systems, revenue cycle management (RCM), human resources (HR) and accounting, helping larger practices increase bargaining power with hospitals and payers

.png) Technology as a Catalyst

Technology as a Catalyst

On the technology side of things, the imaging market is becoming more complex and data intensive as increasing exam volume and new imaging technologies produce larger and larger data sets. Opportunities in imaging IT, enterprise imaging, artificial intelligence (AI) and workflow solutions have emerged, as healthcare organizations look to drive efficiencies and find new ways to access and analyze data. In the enterprise imaging space, in particular, we witnessed a flurry of activity in 2020 as health system and physician provider organizations move more toward cloud-based, end-to-end imaging solutions.

In January 2020, Intelerad Medical Systems, a leading global provider of enterprise workflow and medical imaging software solutions, was acquired by Hg Capital, a specialist private equity investor focused on software and service businesses.

2 In August 2020, Change Healthcare acquired Nucleus.io, a fully enabled cloud-native imaging and workflow technology platform.

2 The continued proliferation of integrated imaging software solutions will have wide-ranging impact across a variety of areas, including cost savings, clinical outcomes, population health management, and improved preventative care models.

These dynamics have further contributed to a wave of strategic consolidation and private equity investment in radiology services over the last several years. Founded in 2012 by venture capital firm New Enterprise Associates and their management, Radiology Partners has been the leading consolidator in radiology over the last decade. Starr Investment Holdings invested $700 million into the business in July 2019

2 to help fuel its continued growth, and in September 2020 Radiology Partners acquired MEDNAX Radiology Solutions for $885 million, growing its practice from 1,600 to 2,400 radiologists. LucidHealth, a leading radiology services platform backed by Excellere Partners, has more than doubled in size in the last four years, with a good portion of that growth coming through M&A. Over this time, the business has grown from a practice of ~90 subspecialist physicians in a single state (Ohio) to more than 200 radiologists serving care sites in five states across the Midwest today.

.png?width=550&height=495)

Several businesses have forged unique blended models, combining a footprint of outpatient imaging centers with a radiology services strategy. U.S. Radiology Specialists (USRS), jointly founded in 2018 by Charlotte Radiology and Welsh, Carson, Anderson & Stowe, has partnered with numerous sub-specialty radiology practices and outpatient imaging operators, completing six deals over the last 18 months. These efforts have helped USRS assemble a national radiology network, with more than 3,100 employees and over 145 outpatient imaging centers across 14 states, conducting more than six million studies annually. SimonMed Imaging, founded in 2003 and led by Dr. John Simon, also has an integrated model operating more than 150 facilities across 9 states with a captive practice of more than 200 subspecialist radiologists. Based in Phoenix, AZ, SimonMed has accelerated its growth over the last several years, first moving into Florida, then consolidating its position in Arizona and California from former joint venture partner Dignity Health in April 2018.

2 Within the last three years SimonMed has added more than 50 centers and over 75 radiologists, expanding its footprint into several key new states, including New York, Texas, Illinois and Wisconsin.

As activity in the U.S. diagnostic imaging and radiology sector continues into 2021, there are several additional platforms in and around the space that are also on our radar:

- Solis Mammography, backed by Madison Dearborn, is the leading provider of breast health and diagnostic services in the country, operating 85 centers in nine major markets

- Shields Health Care Group, based outside of Boston, is the leading network of medical imaging and diagnostic treatment facilities in New England and partners with hospitals and health systems throughout the region

- ExpertMRI, based in Los Angeles, is one of the leading diagnostic imaging providers in Southern California with more than 20 locations in the region and a focus on personal injury case work around traumatic brain injury, orthopedic, neck and spine imaging

We are excited to continue to track this dynamic sector. In the meantime, contact us to learn more and let us know what you think!

1 Advanced imaging includes magnetic resonating imaging (MRI), computerized tomography (CT), and positron emission tomography (PET) scans; routine imaging includes X-ray, ultrasound, mammography and fluoroscopy

2TripleTree professionals provided advisory services with respect to this transaction; Nucleus.io was a portfolio company of TT Capital Partners (TTCP)